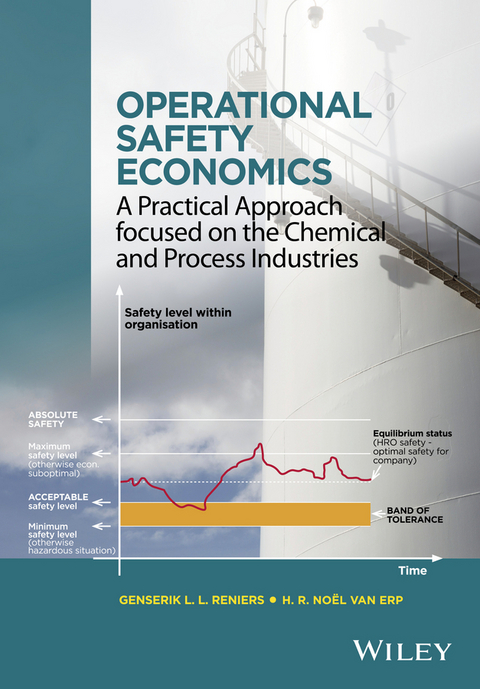

Operational Safety Economics (eBook)

Describes how to make economic decisions regading safety in the chemical and process industries

- Covers both technical risk assessment and economic aspects of safety decision-making

- Suitable for both academic researchers and practitioners in industry

- Addresses cost-benefit analysis for safety investments

Genserik Reniers is Professor at the TU Delft (Safety Science Group, Faculty of Technology, Policy and Management, The Netherlands), Professor at the HUB campus of the KULeuven (CEDON, Faculty of Economics and Management, Belgium) and at the University of Antwerp (ARGoSS, Faculty of Applied Economic Sciences, Belgium).

He received his PhD in Applied Economic Sciences from the University of Antwerp, after completing a Master's degree in Chemical Engineering at the Vrije Universiteit Brussels. His main research interests concern the collaboration and interaction between safety and security topics and socio-economic optimization within the chemical industry.

Genserik has authored, co-authored, edited or co-edited more than 20 books in the field of safety and/or security in the process industries, and he is Receiving editor for the Journal of Loss Prevention in the Process Industries (JLPPI), and Associate Editor of Safety Science, two very well-known academic journals in the research field. He has taught safety and security economics (as part of larger courses) since 2006 both at the University of Antwerp and at the HUB-campus of the KULeuven.

Describes how to make economic decisions regading safety in the chemical and process industries Covers both technical risk assessment and economic aspects of safety decision-making Suitable for both academic researchers and practitioners in industry Addresses cost-benefit analysis for safety investments

Genserik Reniers is Professor at the TU Delft (Safety Science Group, Faculty of Technology, Policy and Management, The Netherlands), Professor at the HUB campus of the KULeuven (CEDON, Faculty of Economics and Management, Belgium) and at the University of Antwerp (ARGoSS, Faculty of Applied Economic Sciences, Belgium). He received his PhD in Applied Economic Sciences from the University of Antwerp, after completing a Master's degree in Chemical Engineering at the Vrije Universiteit Brussels. His main research interests concern the collaboration and interaction between safety and security topics and socio-economic optimization within the chemical industry. Genserik has authored, co-authored, edited or co-edited more than 20 books in the field of safety and/or security in the process industries, and he is Receiving editor for the Journal of Loss Prevention in the Process Industries (JLPPI), and Associate Editor of Safety Science, two very well-known academic journals in the research field. He has taught safety and security economics (as part of larger courses) since 2006 both at the University of Antwerp and at the HUB-campus of the KULeuven.

Cover 1

Title Page 5

Copyright 6

Contents 7

Preface 13

Disclaimer 16

Acknowledgements 17

List of Acronyms 19

Chapter 1 Introduction 21

1.1 The "Why" of Operational Safety 21

1.2 Back to the Future: the Economics of Operational Safety 23

1.3 Difficulties in Operational Safety Economics 24

1.4 The Field of Operational Safety within the Profitability of an Organization 25

1.5 Conclusions 26

References 27

Chapter 2 Operational Risk, Operational Safety, and Economics 28

2.1 Defining the Concept of Operational Risk 28

2.2 Dealing with Operational Risks 30

2.3 Types of Operational Risk 31

2.4 The Importance of Operational Safety Economics for a Company 35

2.5 Balancing between Productivity and Safety 38

2.6 The Safety Equilibrium Situation or "HRO Safety" 39

2.6.1 HRO Principle 1: Targeted at Disturbances 40

2.6.2 HRO Principle 2: Reluctant for Simplification 41

2.6.3 HRO Principle 3: Sensitive toward Implementation 41

2.6.4 HRO Principle 4: Devoted to Resiliency 41

2.6.5 HRO Principle 5: Respectful for Expertise 42

2.7 The Egg Aggregated Model (TEAM) of Safety Culture 42

2.8 Safety Futures 44

2.9 The Controversy of Economic Analyses 45

2.10 Scientific Requirements for Adequate Economic Assessment Techniques 46

2.11 Four Categories of Data 47

2.12 Improving Decision-making Processes for Investing in Safety 48

2.13 Conclusions 49

References 50

Chapter 3 Economic Foundations 51

3.1 Macroeconomics and Microeconomics 51

3.2 Safety Demand and Long-term Average Cost of Production 52

3.2.1 Safety Demand 52

3.2.2 Long-term Average Cost of Production and Safety 53

3.3 Safety Value Function 55

3.4 Expected Value Theory, Value at Risk, and Safety Attitude 57

3.4.1 Expected Value Theory 57

3.4.2 Value at Risk 58

3.4.3 Safety Attitude 59

3.5 Safety Utilities 60

3.5.1 Safety Utility Functions 60

3.5.2 Expected Utility and Certainty Equivalent 61

3.6 Measuring Safety Utility Functions 62

3.7 Preferences of Safety Management - Safety Indifference Curves 63

3.8 Measuring Safety Indifference Curves 65

3.8.1 Questionnaire-based Type I Safety Indifference Curves 65

3.8.2 Problems with Determining an Indifference Curve 68

3.8.3 Time Trade-off-based Safety Utilities for Type II Safety Indifference Curves 68

3.9 Budget Constraint and n-Dimensional Maximization Problem Formulation 70

3.10 Determining Optimal Safety Management Preferences within the Budget Constraint for a Two-dimensional Problem 72

3.11 Conclusions 74

References 74

Chapter 4 Operational Safety Decision-making and Economics 75

4.1 Economic Theories and Safety Decisions 75

4.1.1 Introduction 75

4.1.2 Expected Utility Theory 76

4.1.3 Prospect Theory 76

4.1.4 Bayesian Decision Theory 80

4.1.5 Risk and Uncertainty 80

4.1.6 Making a Choice Out of a Set of Options 82

4.1.7 Impact of Affect and Emotion in the Process of Making a Choice between Alternatives 84

4.1.8 Influence of Regret and Disappointment on Decision-making 84

4.1.9 Impact of Intuition on Decision-making 85

4.1.10 Other Influences while Making Decisions 86

4.2 Making Decisions to Deal with Operational Safety 86

4.2.1 Introduction 86

4.2.2 Risk Treatment Option 1: Risk Reduction 87

4.2.3 Risk Treatment Option 2: Risk Acceptance 89

4.2.4 Risk Treatment 90

4.2.5 The "Human Aspect" of Making a Choice between Risk Treatment Alternatives 94

4.3 Safety Investment Decision-making - a Question of Costs and Benefits 96

4.3.1 Costs and Hypothetical Benefits 96

4.3.2 Prevention Benefits 98

4.3.3 Prevention Costs 98

4.4 The Degree of Safety and the Minimum Overall Cost Point 99

4.5 The Type I and Type II Accident Pyramids 103

4.6 Quick Calculation of Type I Accident Costs 105

4.6.1 Accident Metrics 106

4.6.2 A Quick Cost-estimation Approach for Type I Risks 107

4.7 Quick Calculation of Type II Accident Costs 108

4.7.1 Introduction to a Study on Type II Event Decision-making 108

4.7.2 Results of the Study on Type II Event Decision-making 110

4.7.3 Results by Gender 112

4.7.4 Rational and Intuitive Thinking Styles 112

4.7.5 Conclusions of the Study on Type II Event Decision-making 114

4.8 Costs and Benefits and the Different Types of Risk 115

4.9 Marginal Safety Utility and Decision-making 117

4.10 Risk Acceptability, Risk Criteria, and Risk Comparison-Moral Aspects and Value of (Un)safety and Value of Human Life 121

4.10.1 Risk Acceptability 121

4.10.2 Risk Criteria and Risk Comparison 124

4.10.3 Economic Optimization 130

4.10.4 Moral Aspects and Calculation of (Un)safety, Monetizing Risk and Value of Human Life 131

4.11 Safety Investment Decision-making for the Different Types of Risk 143

4.11.1 Safety Investment Decision-making in the Case of Type I Risks 143

4.11.2 Safety Investment Decision-making for Type II Risks 146

4.11.3 Calculation of the Disproportion Factor, taking Societal Acceptability of Risks into Account 150

4.12 Conclusions 162

References 162

Chapter 5 Cost-Benefit Analysis 169

5.1 An Introduction to Cost-Benefit Analysis 169

5.2 Economic Concepts Related to Cost-Benefit Analyses 170

5.2.1 Opportunity Cost 170

5.2.2 Implicit Value of Safety 171

5.2.3 Consistency and Uniformity of Safety Investment Decisions 172

5.2.4 Decision Rule, Present Values, and Discount Rate 174

5.2.5 Different Cost-Benefit Ratios 177

5.3 Calculating Costs 178

5.3.1 Safety Measures 178

5.3.2 Costs of Safety Measures 178

5.4 Calculating Benefits (Avoided Accident Costs) 195

5.4.1 Distinction between Various Accident Costs 196

5.4.2 Avoided Accident Costs 198

5.4.3 Investment Analysis (Economic Concepts Related to Type I Risks) 220

5.5 The Cost of Carrying Out Cost-Benefit Analyses 221

5.6 Cost-Benefit Analysis for Type I Safety Investments 222

5.7 Cost-Benefit Analysis for Type II Safety Investments 222

5.7.1 Introduction 222

5.7.2 Quantitative Assessment Using the Disproportion Factor 224

5.7.3 Decision Model 226

5.7.4 Simulation on Illustrative Case Studies 228

5.7.5 Recommendations with Regard to Using the DF0 236

5.8 Advantages and Disadvantages of Analyses Based on Costs and Benefits 236

5.9 Conclusions 237

References 237

Chapter 6 Cost-effectiveness Analysis 239

6.1 An Introduction to Cost-effectiveness Analysis 239

6.2 Cost-effectiveness Ratio 240

6.3 Cost-effectiveness Analysis Using Constraints 242

6.4 User-friendly Approach for Cost-effectiveness Analysis under Budget Constraint 243

6.4.1 Input Information 243

6.4.2 Approach Cost-effectiveness Working Procedure and Illustrative Example 245

6.4.3 Illustrative Example of the Cost-effectiveness Analysis with Safety Budget Constraint 246

6.4.4 Refinements of the Cost-effectiveness Approach 247

6.5 Cost-effectiveness Calculation Often Used in Industry 252

6.6 Cost-Utility Analysis 253

6.7 Conclusions 253

References 253

Chapter 7 Beyond the State-of the Art of Operational Safety Economics: Bayesian Decision Theory 255

7.1 Introduction 255

7.2 Bayesian Decision Theory 257

7.2.1 The Criterion of Choice as a Degree of Freedom 257

7.2.2 The Proposed Criterion of Choice 260

7.2.3 The Algorithmic Steps of the Bayesian Decision Theory 261

7.3 The Allais Paradox 261

7.3.1 The Choosing of Option 1B 262

7.3.2 The Choosing of Option 2A 263

7.3.3 How to Resolve an Allais Paradox 265

7.4 The Ellsberg Paradox 265

7.5 The Difference in Riskiness Between Type I and Type II Events 267

7.5.1 Outcome Probability Distributions with Equal Expectation Values 267

7.5.2 The Risk of the Type I Event 268

7.5.3 The Risk of the Type II Event 269

7.5.4 Comparing the Risks of the Type I and Type II Events 270

7.6 Discussion 271

7.7 Conclusions 273

References 273

Chapter 8 Making State-of-the-Art Economic Thinking Part of Safety Decision-making 274

8.1 The Decision-making Process for an Economic Analysis 274

8.2 Application of Cost-Benefit Analysis to Type I Risks 276

8.2.1 Safety Investment Option 1 277

8.2.2 Safety Investment Option 2 279

8.3 Decision Analysis Tree Approach 282

8.3.1 Scenario Thinking Approach 283

8.3.2 Cost Variable Approach 283

8.4 Safety Value Function Approach 287

8.5 Multi-attribute Utility Approach 290

8.6 The Borda Algorithm Approach 292

8.7 Bayesian Networks in Relation to Operational Safety Economics 294

8.7.1 Constructing a Bayesian Network 294

8.7.2 Modeling a Bayesian Network to Analyze Safety Investment Decisions 296

8.8 Limited Memory Influence Diagram (LIMID) Approach 300

8.9 Monte Carlo Simulation for Operational Safety Economics 304

8.10 Multi-criteria Analysis (MCA) in Relation to Operational Safety Economics 306

8.11 Game Theory Considerations in Relation to Operational Safety Economics 312

8.11.1 An Introduction to Game Theory 312

8.11.2 The Prisoner's Dilemma Game 314

8.11.3 The Prisoner's Dilemma Game Involving Many Players 315

8.12 Proving the Usefulness of a Disproportion Factor (DF) for Type II Risks: an Illustrative (Toy) Problem 317

8.12.1 The Problem of Choice 317

8.12.2 The Expected Outcome Theory Solution 318

8.12.3 The Expected Utility Solution 319

8.12.4 The Bayesian Decision Theory Solution 320

8.12.5 A Numerical Example Comparing Expected Outcome Theory, Expected Utility Theory, and Bayesian Decision Theory 322

8.12.6 Discussion of the Illustrative (Toy) Problem - Link with the Disproportion Factor 324

8.13 Decision Process for Carrying Out an Economic Analysis with Respect to Operational Safety 325

8.14 Conclusions 328

References 329

Chapter 9 General Conclusions 330

Index 333

EULA 339

| Erscheint lt. Verlag | 3.8.2016 |

|---|---|

| Sprache | englisch |

| Themenwelt | Naturwissenschaften ► Chemie ► Technische Chemie |

| Technik | |

| Wirtschaft | |

| Schlagworte | Bayesian Decision Theory • Business & Management in Chemistry • Chemical and Process Industry • chemical engineering • Chemie • Chemische Verfahrenstechnik • Chemistry • Cost-Benefit Analysis • cost-effectiveness analysis • Ethical Aspects of Safety • Industrial Chemistry • Industrielle Chemie • Loss Aversion • Micro-Economics and Safety • Operational Safety Economics • Process Safety • Prospect Theory • Prozesssicherheit • Technische u. Industrielle Chemie • Wirtschaft • Wirtschaft u. Management in der Chemischen Industrie |

| ISBN-13 | 9781118871539 / 9781118871539 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich