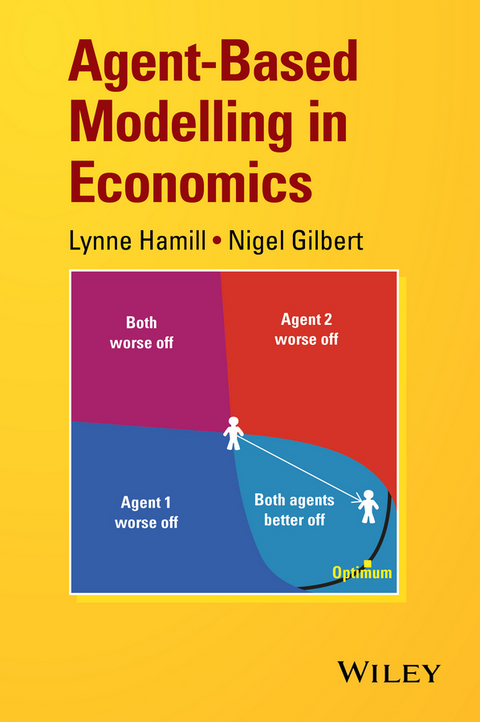

Agent-Based Modelling in Economics (eBook)

John Wiley & Sons (Verlag)

978-1-118-94551-3 (ISBN)

Agent-based modelling in economics

Lynne Hamill and Nigel Gilbert, Centre for Research in Social Simulation (CRESS), University of Surrey, UK

New methods of economic modelling have been sought as a result of the global economic downturn in 2008.This unique book highlights the benefits of an agent-based modelling (ABM) approach. It demonstrates how ABM can easily handle complexity: heterogeneous people, households and firms interacting dynamically. Unlike traditional methods, ABM does not require people or firms to optimise or economic systems to reach equilibrium. ABM offers a way to link micro foundations directly to the macro situation.

Key features:

- Introduces the concept of agent-based modelling and shows how it differs from existing approaches.

- Provides a theoretical and methodological rationale for using ABM in economics, along with practical advice on how to design and create the models.

- Each chapter starts with a short summary of the relevant economic theory and then shows how to apply ABM.

- Explores both topics covered in basic economics textbooks and current important policy themes; unemployment, exchange rates, banking and environmental issues.

- Describes the models in pseudocode, enabling the reader to develop programs in their chosen language.

- Supported by a website featuring the NetLogo models described in the book.

Agent-based Modelling in Economics provides students and researchers with the skills to design, implement, and analyze agent-based models. Third year undergraduate, master and doctoral students, faculty and professional economists will find this book an invaluable resource.

Nigel Gilbert, Professor of Sociology and Director of CRESS, University of Surrey, UK.

Lynne Hamill, Centre of Research in Social Simulation (CRESS), University of Surrey, UK.

Agent-based modelling in economics Lynne Hamill and Nigel Gilbert, Centre for Research in Social Simulation (CRESS), University of Surrey, UK New methods of economic modelling have been sought as a result of the global economic downturn in 2008.This unique book highlights the benefits of an agent-based modelling (ABM) approach. It demonstrates how ABM can easily handle complexity: heterogeneous people, households and firms interacting dynamically. Unlike traditional methods, ABM does not require people or firms to optimise or economic systems to reach equilibrium. ABM offers a way to link micro foundations directly to the macro situation. Key features: Introduces the concept of agent-based modelling and shows how it differs from existing approaches. Provides a theoretical and methodological rationale for using ABM in economics, along with practical advice on how to design and create the models. Each chapter starts with a short summary of the relevant economic theory and then shows how to apply ABM. Explores both topics covered in basic economics textbooks and current important policy themes; unemployment, exchange rates, banking and environmental issues. Describes the models in pseudocode, enabling the reader to develop programs in their chosen language. Supported by a website featuring the NetLogo models described in the book. Agent-based Modelling in Economics provides students and researchers with the skills to design, implement, and analyze agent-based models. Third year undergraduate, master and doctoral students, faculty and professional economists will find this book an invaluable resource.

Nigel Gilbert, Professor of Sociology and Director of CRESS, University of Surrey, UK. Lynne Hamill, Centre of Research in Social Simulation (CRESS), University of Surrey, UK.

Title Page 5

Copyright Page 6

Contents 7

Preface 10

Copyright notices 11

Chapter 1 Why agent-based modelling is useful for economists 13

1.1 Introduction 13

1.2 A very brief history of economic modelling 13

Traditional macroeconomic models 14

Dynamic stochastic general equilibrium models 14

Complexity economics 14

The impact of the 2008 economic crisis 15

1.3 What is ABM? 16

1.4 The three themes of this book 17

Heterogeneity 17

Dynamics 17

Interactions 18

1.5 Details of chapters 18

Chapter 2: Starting agent-based modelling 18

Chapter 3: Heterogeneous demand 18

Chapter 4: Social demand 19

Chapter 5: Benefits of barter 19

Chapter 6: The market 19

Chapter 7: Labour market 19

Chapter 8: International trade 20

Chapter 9: Banking 20

Chapter 10: Tragedy of the commons 20

Chapter 11: Summary and conclusions 20

The models 20

References 21

Chapter 2 Starting agent-based modelling 23

2.1 Introduction 23

2.2 A simple market: the basic model 24

2.3 The basic framework 25

2.4 Enhancing the basic model: adding prices 30

2.5 Enhancing the model: selecting traders 33

2.6 Final enhancement: more economically rational agents 35

2.7 Running experiments 37

2.8 Discussion 38

Appendix 2.A The example model: full version 39

References 40

Chapter 3 Heterogeneous demand 41

3.1 Introduction 41

3.2 Modelling basic consumer demand theory 42

Distributing budgets 44

Giving preferences to households 46

3.3 Practical demand modelling 51

3.4 Discussion 55

Appendix 3.A How to do it 58

Budget distribution 58

Utility function-based demand model 59

Practical demand model 60

References 64

Chapter 4 Social demand 65

4.1 Introduction 65

4.2 Social networks 65

4.3 Threshold models 68

Infection models 71

Influence models 71

4.4 Adoption of innovative products 74

4.5 Case study: household adoption of fixed-line phones in Britain 76

Modelling demographic changes 76

Modelling income 76

An income-only model 78

Modelling network effects 79

4.6 Discussion 82

Appendix 4.A How to do it 82

Social circles model 82

Threshold model 84

Phone adoption model 86

References 90

Chapter 5 Benefits of barter 92

5.1 Introduction 92

5.2 One-to-one barter 93

The Edgeworth Box 95

Dynamics of the Edgeworth Box 96

5.3 Red Cross parcels 100

Introducing shortages 106

5.4 Discussion 108

Appendix 5.A How to do it 109

Edgeworth Box game 109

Edgeworth Box random model 110

Red Cross parcels model 112

References 116

Chapter 6 The market 117

6.1 Introduction 117

6.2 Cournot–Nash model 117

Introduction 117

The agent-based model 118

6.3 Market model 120

Introduction 120

Consumers 124

Shops 125

Results 129

6.4 Digital world model 129

Introduction 129

Sellers 131

Consumers 132

Results 132

6.5 Discussion 136

Appendix 6.A How to do it 137

The Cournot–Nash model 137

Shops model 139

Digital world model 141

References 143

Chapter 7 Labour market 144

7.1 Introduction 144

The labour force 144

Employers 151

Summary 154

7.2 A simple labour market model 154

Stage 1: Wages 154

Stage 2: Job search 155

Stage 3: The Guildford labour market 160

Results 162

7.3 Discussion 163

Appendix 7.A How to do it : 167

Wage distribution model 167

Things to try using the wage distribution model 167

Job search model 169

Things to try using the job search model 169

Guildford labour market model 171

References 173

Chapter 8 International trade 175

8.1 Introduction 175

Definition of exchange rates 175

Nominal exchange rates 175

Effective exchange rates 176

Real exchange rates 177

Purchasing power parity 178

Interest rate parity 178

Exchange rate regimes 180

The experience of the British pound, the US dollar and the euro 182

8.2 Models 184

Introduction 184

Assumptions 185

Inflation 186

Depreciation 191

Exogenous drop in demand for exports 191

Fiscal change 194

8.3 Discussion 195

Appendix 8.A How to do it 197

International trade model 197

References 199

Chapter 9 Banking 201

9.1 Introduction 201

Fractional reserve banking 201

Banking crises and the regulation of banks 204

A simple example 208

9.2 The banking model 210

A basic example 210

Introducing the capital adequacy ratio target 214

Affordability and different types of loans 214

Adding interest 215

A shock to the system 216

9.3 Discussion 218

Appendix 9.A How to do it 221

Banking model 221

Things to try 222

References 224

Chapter 10 Tragedy of the commons 226

10.1 Introduction 226

Economic analysis 227

10.2 Model 230

The carrying capacity of the meadow 230

Managing the meadow 232

10.3 Discussion 237

Appendix: 10.A How to do it: : 240

Carrying capacity model 240

Meadow management model 242

References 244

Chapter 11 Summary and conclusions 246

11.1 Introduction 246

11.2 The models 246

11.3 What makes a good model? 249

11.4 Pros and cons of ABM 250

References 251

Further reading and resources 252

Index 254

EULA 259

| Erscheint lt. Verlag | 2.11.2015 |

|---|---|

| Sprache | englisch |

| Themenwelt | Mathematik / Informatik ► Mathematik ► Statistik |

| Mathematik / Informatik ► Mathematik ► Wahrscheinlichkeit / Kombinatorik | |

| Sozialwissenschaften ► Soziologie ► Empirische Sozialforschung | |

| Technik | |

| Wirtschaft ► Allgemeines / Lexika | |

| Wirtschaft ► Volkswirtschaftslehre | |

| Schlagworte | ABM • agent-based • Complexity • Dynamics • Economics • Economic Theory • Heterogeneity • Interactions • Markets • Micro-Foundations • Modelling • netlogo • Research Methodologies • Sociology • Soziologie • Soziologische Forschungsmethoden • Statistics • Statistics for Social Sciences • Statistik • Statistik in den Sozialwissenschaften • Volkswirtschaftslehre • Wirtschaftstheorie |

| ISBN-10 | 1-118-94551-4 / 1118945514 |

| ISBN-13 | 978-1-118-94551-3 / 9781118945513 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich