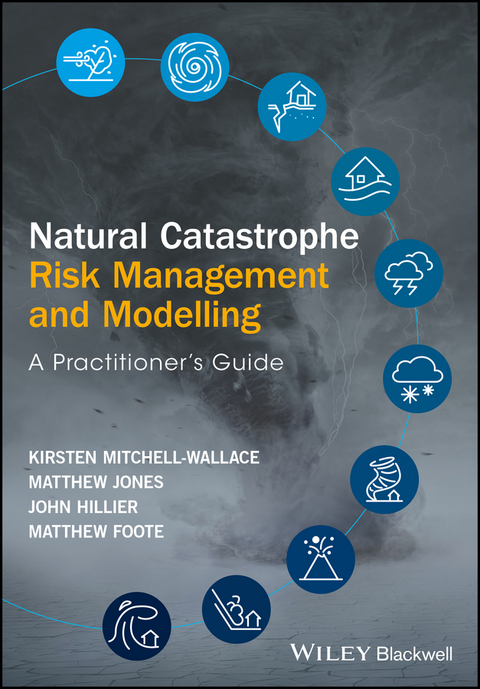

Natural Catastrophe Risk Management and Modelling (eBook)

John Wiley & Sons (Verlag)

978-1-118-90607-1 (ISBN)

This book covers both the practical and theoretical aspects of catastrophe modelling for insurance industry practitioners and public policymakers. Written by authors with both academic and industry experience it also functions as an excellent graduate-level text and overview of the field.

Ours is a time of unprecedented levels of risk from both natural and anthropogenic sources. Fortunately, it is also an era of relatively inexpensive technologies for use in assessing those risks. The demand from both commercial and public interests-including (re)insurers, NGOs, global disaster management agencies, and local authorities-for sophisticated catastrophe risk assessment tools has never been greater, and contemporary catastrophe modelling satisfies that demand.

Combining the latest research with detailed coverage of state-of-the-art catastrophe modelling techniques and technologies, this book delivers the knowledge needed to use, interpret, and build catastrophe models, and provides greater insight into catastrophe modelling's enormous potential and possible limitations.

- The first book containing the detailed, practical knowledge needed to support practitioners as effective catastrophe risk modellers and managers

- Includes hazard, vulnerability and financial material to provide the only independent, comprehensive overview of the subject, accessible to students and practitioners alike

- Demonstrates the relevance of catastrophe models within a practical, decision-making framework and illustrates their many applications

- Includes contributions from many of the top names in the field, globally, from industry, academia, and government

Natural Catastrophe Risk Management and Modelling: A Practitioner's Guide is an important working resource for catastrophe modelling analysts and developers, actuaries, underwriters, and those working in compliance or regulatory functions related to catastrophe risk. It is also valuable for scientists and engineers seeking to gain greater insight into catastrophe risk management and its applications.

Kirsten Mitchell-Wallace, PhD is EMEA Regional Head of Catastrophe Management at SCOR, Zürich, Switzerland

Matthew Jones, PhD is Director at Cat Risk Intelligence, UK

John Hillier, PhD is Senior Lecturer in Physical Geography at Loughborough University, Loughborough, UK

Matthew Foote is Group Head of Exposure Management at Argo Group International Holdings, London, UK

This book covers both the practical and theoretical aspects of catastrophe modelling for insurance industry practitioners and public policymakers. Written by authors with both academic and industry experience it also functions as an excellent graduate-level text and overview of the field. Ours is a time of unprecedented levels of risk from both natural and anthropogenic sources. Fortunately, it is also an era of relatively inexpensive technologies for use in assessing those risks. The demand from both commercial and public interests including (re)insurers, NGOs, global disaster management agencies, and local authorities for sophisticated catastrophe risk assessment tools has never been greater, and contemporary catastrophe modelling satisfies that demand. Combining the latest research with detailed coverage of state-of-the-art catastrophe modelling techniques and technologies, this book delivers the knowledge needed to use, interpret, and build catastrophe models, and provides greater insight into catastrophe modelling s enormous potential and possible limitations. The first book containing the detailed, practical knowledge needed to support practitioners as effective catastrophe risk modellers and managers Includes hazard, vulnerability and financial material to provide the only independent, comprehensive overview of the subject, accessible to students and practitioners alike Demonstrates the relevance of catastrophe models within a practical, decision-making framework and illustrates their many applications Includes contributions from many of the top names in the field, globally, from industry, academia, and government Natural Catastrophe Risk Management and Modelling: A Practitioner s Guide is an important working resource for catastrophe modelling analysts and developers, actuaries, underwriters, and those working in compliance or regulatory functions related to catastrophe risk. It is also valuable for scientists and engineers seeking to gain greater insight into catastrophe risk management and its applications.

Kirsten Mitchell-Wallace, PhD is EMEA Regional Head of Catastrophe Management at SCOR, Zürich, Switzerland Matthew Jones, PhD is Director at Cat Risk Intelligence, UK John Hillier, PhD is Senior Lecturer in Physical Geography at Loughborough University, Loughborough, UK Matthew Foote is Group Head of Exposure Management at Argo Group International Holdings, London, UK

List of Contributors and Acknowledgements

We, the main authors, wish to expressly thank the other authors and reviewers who have contributed to this book and made it possible. Catastrophe risk management and modelling is a discipline that draws upon a wide range of knowledge and expertise, so we could not have created a credible practitioner's guide without the widespread support that we have received from the catastrophe modelling community.

Each main author had oversight of one of the main chapters (i.e. 2–5), and sculpted it as appropriate; the structure of each topic and nature of the material required different approaches by chapter. This said, we have all re-written, polished and homogenized all the chapters of the book to produce what we hope is a coherent journey through the topic of catastrophe risk management and modelling.

We have chosen to accredit ourselves in reverse alphabetical order, selected with a degree of randomness befitting the subject matter of this guide.

As well as the four main authors, many contributors provided material for chapters, or sub-chapters, of the book; sometimes an author contributed in more than one place. These contributions are summarized in the table below, and, as appropriate, authors are listed at the start of sections that they co-wrote.

The contributions of the many external reviewers drawn from outside the editorial team were also invaluable; in particular, we are indebted to Alan Calder, George Cooper, Jeff Gall, Claire Crerar, Paul Nunn and Claire Souch who reviewed the entire book or a large part of it.

We thank Wiley's editors and team for giving us the opportunity to produce this guide and assisting us along the way.

Main Authors

This guide has four main authors who also acted as editors. Here, we introduce ourselves in reverse alphabetical order.

Kirsten Mitchell-Wallace is the Regional Cat Manager for Europe, Middle East and Africa at SCOR, leading cat teams based in Zurich and Paris in support of property treaty business written from this region, including US Cat. Before this, she was Head of Cat Pricing and Methodology and responsible for coordinating the development of SCOR's own view of risk, as well as managing the Zurich-based cat team. Prior to joining SCOR in 2009, she was a Senior Catastrophe Risk Analyst at Willis, London, for 5 years, working first on European, then Japanese business. She started her career with two years at Risk Management Solutions in London and two years at risk management consultancy, Risk Solutions, from 2001. Kirsten has a PhD in Atmospheric Physics from Imperial College, London, and a Masters in Meteorology from Reading University, as well as a degree in Chemistry from the University of Bristol. She also has an International Diploma in Risk Management from the Institute of Risk Management. Kirsten is passionate about catastrophe modelling.

Acknowledgments: I would first like to thank my husband, Richard, for keeping our family fed and Arthur clothed throughout this project. Without his incredible support, my contribution could never have been possible.

I would then also like to thank the many people outside the editorial team who reviewed my chapter and made valuable suggestions: Sibylle Steimen, Claire Crerar, Alan Calder, Paul Nunn, Claire Souch, Iakovos Barmpadimos, Roger Bordoy, George Cooper, Thomas Premier and Thomas Linford. Thanks to Parvez Chowdury and Tobias Hoffmann for their review of the actuarial matter. Special thanks to Tom for associated discussions and to Paul for his support of this endeavour.

I would like to thank my many co-authors for their contributions and for being, without exception, a pleasure to work with. I have learned a lot! Thank you also to my fellow editors for a real team effort. In loving memory of my father, Derrick G. Mitchell.

Matthew Jones is the founding Director of Cat Risk Intelligence, a UK-based company providing catastrophe risk management consultancy to the (re)insurance industry.

In his previous role as Global Head of Catastrophe Management for Zurich Insurance Group, Matthew led the organizational change required to establish a global catastrophe management team with consistent processes to provide catastrophe knowledge, systems, models and services across Zurich's general insurance lines of business. He worked for Zurich for fourteen years, including various roles in the actuarial pricing and catastrophe risk management fields. Prior to this Matthew was a reinsurance pricing actuary for St Paul Re in London.

Matthew graduated from the University of Nottingham in 1993 with a degree in Physics. He then completed a PhD in Oceanography and Remote Sensing from University College London, while being based at the UK's National Oceanography Centre in Southampton. He is a Fellow of the Institute and Faculty of Actuaries.

Acknowledgments: I would like to thank my wife Zoe, and my children, Adam, Lauren and Becky, for their love, support and patience. I am extremely grateful to Jane Hayes for allowing me a sabbatical from Zurich to help write some of this book. I am also very thankful to Alan Calder, Jeff Gall and Claire Souch for the time they put into reviewing and making improvements to Chapter 5; to Fortunat Kind for his input and improvements (including the ‘Christmas tree’ diagram!); to Gary Hemming for his review of some actuarial pricing aspects; to Federico Waisman for allowing many of his model comparison exhibits to be included; and to Ye Liu for some very helpful statistical discussions.

John Hillier is currently a Senior Lecturer at Loughborough University, with research interests that include various geo-hazards (e.g. earthquake, landslide, flooding, extra-tropical cyclones), multi-hazard risk to property and infrastructure, use of impacts (e.g. loss data) to gain insights into physical processes, and inter-dependencies (i.e. ‘links’ or interactions) between perils.

He received B.A. (M.A. Cantab) and M.Sci. degrees in Natural Sciences specializing in Geology from the University of Cambridge, and a D.Phil degree in Marine Geophysics from the University of Oxford.

After studying he was awarded a research fellowship at St Catharine's College, Cambridge, and then worked for Zurich Insurance as a catastrophe modeller.

Acknowledgments: I am extremely grateful as ever for the love, tolerance and support of my wife, Katie; I do not say this enough, so I would like to say it explicitly here. My love and thanks also to Ben and Charlotte for putting up with Daddy working when you could clearly think of better things I should be doing.

Academically, I appreciate the stoic perseverance and professionalism of all 16 contributors on the perils in Chapter 3 in the face of requests for more detail in fewer words, or for correcting errors I inadvertently introduced when re-writing an initial submission to half its original length. The following reviewers did a great job of making sure we did a robust and thorough job, with numbers in brackets indicating sections: Rebecca Bell (Imperial College) [3.7], Thierry Corti (Swiss Re) [3.6], Mark Dixon (RMS) [3.3], Juergen Grieser (RMS) [3.4], Joanna Faure-Walker (UCL) [3.8], Greg Holland (NCAR) [3.2], Edmund Penning Rowsell [3.5], Tiziana Rossetto [3.9], Robin Spence [3.10]. This said, any remaining errors should be considered mine and mine alone.

Matthew Foote is an exposure management specialist with over twenty years of experience in the (re)insurance industry, including roles with Willis and Guy Carpenter reinsurance brokers, Risk Management Solutions, Mitsui Sumitomo and most recently Argo Group. For seven years Matthew was the Research Director of the Willis Research Network, responsible for the coordination and development of industrial-academic collaborations involving over fifty research organisations and universities.

Matthew began his career as a cartographer and geographic information specialist, working primarily with earth observation (EO) data and other imagery-based data. He has a First Class degree in Geography from Birkbeck, University of London, is a Fellow of the Royal Geographical Society/IBG and a Chartered Geographer.

Acknowledgments: My thanks are short and simple, first, to Paula, my wife, for all she has done, and to my children Ciara and Michael for inspiring me. I would also like to particularly acknowledge the efforts of Barbara Page, Adam Podlaha, Shane Latchman, Rashmin Gunasekera and Claire Souch, and to express my gratitude to Stuart Lane for his advice in the very early stages of developing this book.

Contributors

The following practitioners and academics contributed to this guide. For volunteering your time and expertise, we thank you.

| Contributor* | Section(s) | Biography |

| Šárka Černá | 4.3 | Šárka Černá works in the business development team in Impact Forecasting doing product development and working with clients. She benefits from five years working as a catastrophe model developer, where she mainly focused on the mathematical and statistical aspects of flood models (e.g. Switzerland). She is involved in the development of the ELEMENTS platform, including testing and validation procedures for Solvency II. After joining Aon Benfield in 2010, Šárka was appointed their Chair of Research in 2014. Prior to 2010, she worked at the Institute of Thermomechanics of the Czech... |

| Erscheint lt. Verlag | 24.4.2017 |

|---|---|

| Sprache | englisch |

| Themenwelt | Mathematik / Informatik ► Mathematik |

| Naturwissenschaften ► Biologie ► Ökologie / Naturschutz | |

| Naturwissenschaften ► Geowissenschaften | |

| Technik ► Bauwesen | |

| Technik ► Umwelttechnik / Biotechnologie | |

| Schlagworte | actuarial modeling data selection • actuarial modeling strategies • actuarial risk assessment • Angew. Wahrscheinlichkeitsrechn. u. Statistik / Modelle • Applied Probability & Statistics - Models • Bauingenieur- u. Bauwesen • catastrophe management • Catastrophe modeling • catastrophe modeling applications • catastrophe modeling data • catastrophe modeling data selection • catastrophe modeling design • catastrophe modeling for financial analysts • catastrophe modeling for insurers • catastrophe modeling software • catastrophe modeling strategies • catastrophe modeling technologies • catastrophe risk modeling technologies • catastrophe risk modeling theory • cat modeling • cat modeling examples • Civil Engineering & Construction • earthquake risk modeling • Environmental Science • Environmental Studies • Erd- u. Grundbau • global warming risk modeling • how to build catastrophe models • insurance risk modeling • man-made catastrophe risk modeling • modeling catastrophe risk • modeling insurance risk • natural disaster risk modeling • Naturkatastrophe • risk management modeling • Soil (Civil Engineering) • Statistics • Statistik • terrorism risk modeling • Umweltforschung • Umweltwissenschaften • what is cat modeling |

| ISBN-10 | 1-118-90607-1 / 1118906071 |

| ISBN-13 | 978-1-118-90607-1 / 9781118906071 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich