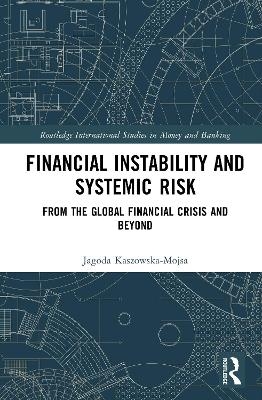

Financial Instability and Systemic Risk

Routledge (Verlag)

978-1-041-26027-1 (ISBN)

- Noch nicht erschienen (ca. Mai 2026)

- Versandkostenfrei

- Auch auf Rechnung

- Artikel merken

The Global Financial Crisis revealed that systemic fragility arises not only from identifiable risks but also from systemic uncertainty—the endogenous and often unpredictable dynamics that build up within financial systems and amplify across time and space. More than a decade later, this dual challenge remains pressing as the rising inequality and geopolitical insecurity have underscored the vulnerability of interconnected economies and societies.

This book illustrates how agent-based modelling (ABM) can enrich the study of crises, systemic risk and uncertainty, and the distributional effects of policies that are designed to contain them. Rather than treating crises as external shocks, the book highlights how fragility can emerge endogenously within economies that are understood as complex, evolving systems. Through clear explanations and targeted applications, it not only demonstrates how ABM can capture the effects of macroprudential regulation on the real economy and inequality and shed light on moments of financial instability but also provides a practical guide to building such data-driven models in the first place. At the same time, it situates these insights within a broader discussion of contagion, procyclicality, and global financial regulation, thus connecting the modelling results with ongoing debates on how best to safeguard financial stability. Further, it offers a valuable synthesis of lessons learned from advanced economies, illustrating how institutional design and macroprudential policy can strengthen financial resilience while also generating significant redistributive effects across sectors and households.

The book is primarily aimed at an academic audience of scholars and advanced students in economics, finance, and computational social science. It will also appeal to professionals in central banks, regulators, and policymakers engaged in designing and evaluating macroprudential frameworks.

Jagoda Kaszowska-Mojsa is a researcher and lecturer and holds positions at the National Bank of Poland and Cracow University of Economics, Poland.

Part 1. Systemic Risk and the Global Financial Crisis (GFC) Introduction 1. Defining Systemic Risk and Uncertainty: Nature, Measurement and Modelling 2. Systemic Risk and the 2008-2009 U.S. Financial Crisis: Causes, Course and Consequences 3. The Role of Systemic Risk and Uncertainty in the Development of the EU Crisis Part 2. Macroprudential Policies after the Global Financial Crisis (GFC) 4. Systemic Risk Mitigation Through Regulation and Macroprudential Policies 5. Analysing the Effects of Macroprudential Policies through an

Agent-Based Model with Heterogeneous Agents Conclusions A. The Bewley's Theorems B. A General-Equilibrium Framework for Macroprudential Analysis C. The Data-Driven Agent-Based Model

| Erscheint lt. Verlag | 15.5.2026 |

|---|---|

| Reihe/Serie | Routledge International Studies in Money and Banking |

| Zusatzinfo | 18 Tables, black and white; 6 Line drawings, black and white; 6 Illustrations, black and white |

| Verlagsort | London |

| Sprache | englisch |

| Maße | 156 x 234 mm |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Volkswirtschaftslehre ► Makroökonomie | |

| Wirtschaft ► Volkswirtschaftslehre ► Wirtschaftspolitik | |

| ISBN-10 | 1-041-26027-X / 104126027X |

| ISBN-13 | 978-1-041-26027-1 / 9781041260271 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich