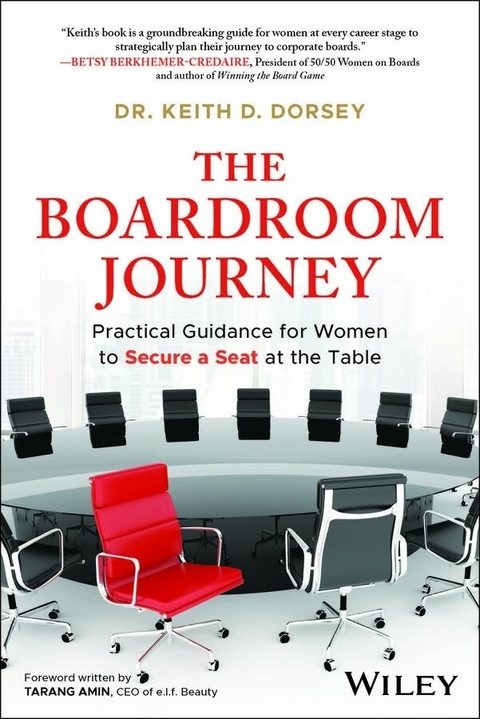

The Boardroom Journey (eBook)

363 Seiten

Wiley (Verlag)

978-1-394-33179-6 (ISBN)

Empower your journey to the corporate boardroom with practical guidance and real-life examples.

The Boardroom Journey: Practical Guidance for Women to Secure a Seat Table by Dr. Keith D. Dorsey offers a clear, actionable roadmap for women at any career stage to strategically build a path to the boardroom. The evidence-based strategies and inspiring success stories presented throughout this book have been gleaned from interviews with hundreds of current corporate board members. Specific tactics are outlined for early career professionals shaping their leadership journey, mid-career professionals navigating their way to the C-suite, and current and retired C-suite executives actively seeking their first (or next) corporate board seat. This book helps readers navigate the nuances of these journeys by moving from theoretical insights to actionable advice.

The Boardroom Journey is an invaluable guide that helps women assess their personal motivations for career growth and board service, identify suitable boards, and enhance their board readiness through assessment tools and exercises. The book also offers strategies for building and leveraging a network of mentors, sponsors, and allies to gain support and boost confidence throughout the board journey.

Inside the book:

- Discover strategies to effectively prepare for board service

- Gain insights on how to present and differentiate oneself via five types of capital

- Learn how to build and leverage a support team

The Boardroom Journey is perfect for anyone aspiring to bring their unique perspective to corporate governance. The evidence-based strategies offered here give readers a proven method for charting an intentional path to executive service and securing a seat at the corporate boardroom table.

DR. KEITH D. DORSEY is a boardroom strategist, author, and thought leader in corporate governance and executive leadership. His research and insights uncover the pathways executives take to board service, helping them navigate the complexities of securing board seats. An experienced board member, he also leads a coaching and membership community focused on execution and accountability - helping leaders apply what they've learned and take action in their boardroom journey.

Empower your journey to the corporate boardroom with practical guidance and real-life examples. The Boardroom Journey: Practical Guidance for Women to Secure a Seat Table by Dr. Keith D. Dorsey offers a clear, actionable roadmap for women at any career stage to strategically build a path to the boardroom. The evidence-based strategies and inspiring success stories presented throughout this book have been gleaned from interviews with hundreds of current corporate board members. Specific tactics are outlined for early career professionals shaping their leadership journey, mid-career professionals navigating their way to the C-suite, and current and retired C-suite executives actively seeking their first (or next) corporate board seat. This book helps readers navigate the nuances of these journeys by moving from theoretical insights to actionable advice. The Boardroom Journey is an invaluable guide that helps women assess their personal motivations for career growth and board service, identify suitable boards, and enhance their board readiness through assessment tools and exercises. The book also offers strategies for building and leveraging a network of mentors, sponsors, and allies to gain support and boost confidence throughout the board journey. Inside the book: Discover strategies to effectively prepare for board service Gain insights on how to present and differentiate oneself via five types of capital Learn how to build and leverage a support team The Boardroom Journey is perfect for anyone aspiring to bring their unique perspective to corporate governance. The evidence-based strategies offered here give readers a proven method for charting an intentional path to executive service and securing a seat at the corporate boardroom table.

CHAPTER ONE

INTRODUCTION

To get something you never had, you have to do something you never did.

—Denzel Washington, University of Pennsylvania Commencement Address, May 16, 2011

It was an exciting time, indeed. The stock market was booming, and nearly everyone from the working poor to the well‐heeled were in it to win it. Shareholders of all stripes piled on as initial public offerings were released. Stock prices soared, money flowed, and times were good.

But like most good things, it wasn't to last. Less than a year later, prices started dropping. One after another, investors were forced to liquidate their positions, triggering a spate of bankruptcies. As similar bubbles started popping around the world, share prices continued to fall. The wealth of many was decimated and significant global economic damage was evident.

Then came the ugly truth. The company that had started it all (and the companies that followed suit) had defrauded the public and their shareholders by misrepresenting their prospects, inflating their stock prices, and encouraging speculative trading. It was corporate scandal writ large, all made possible by insufficient governance.

Does this story sound familiar? Probably. Can you name the company in question? Probably not.

The reason it is difficult to recognize this as England's 1720 South Sea Bubble1 (named after the public‐private partnership titled the South Sea Company) is because problems of inadequate corporate management and governance are far too common. The subsequent three hundred years have been riddled with such events, including corporate accounting scandals; national financial crises; environmental disasters; and ethical, social, and health care crises. Many of these outcomes can be traced back to mismanagement, unethical behavior, and excessive risk‐taking, resulting in severe impacts for the organizations in question, in addition to serious economic and social consequences for organizational stakeholders and the public. The quest to prevent and mitigate such events has heightened efforts to improve how we regulate, manage, and oversee the corporations on which we and our global economy rely.

THE PUSH TO IMPROVE GOVERNANCE

The mandate is simple: corporate governance must improve to ensure effective and responsible business operation, risk mitigation, business continuity, and success. That is how boards protect shareholders' interests.

- Protection of shareholder interests. Strong corporate governance guarantees that management behaves in the shareholders' best interests and gives them access to information and a say in business decisions. By promoting a more sustainable approach to business and balancing management's objectives with the company's long‐term health, better corporate governance can also aid in the shift in emphasis from short‐term gains to long‐term value generation.

- Accountability and appropriate risk‐taking. Sound corporate governance fosters accountability from organization leaders. Executives and board members are held accountable for their activities by establishing clear procedures for decision‐making and reporting. This kind of accountability aids in the prevention of mismanagement, fraud, and unethical activity. Sound company governance also promotes effective risk identification and management, which lower the possibility of monetary and reputational problems.

- Sustainability. Good corporate governance promotes moral and conscientious business practices, including attention to the social and environmental effects of business operations. Robust governance frameworks also have the potential to foster organizational creativity and flexibility balanced with effective decision‐making procedures and cultural practices that honor the company's original concept. These in turn can support a company's long‐term viability and strengthen the company's competitiveness and brand.

Achieving these aims helps preserve customer and public trust, attract investors, and uphold the organization's role as social actor. These outcomes are critical because the success of any corporation depends on the trust of its stakeholders—including the public and its suppliers, employees, and customers. To further safeguard public interest, corporate governance must hold itself to relevant regulations. Companies who disregard these regulations risk legal repercussions as well as reputational harm.

Furthermore, both institutional and individual investors are more inclined to invest in companies that have sound governance, as such practices improve the company's reputation and help reduce costs. Top talent also tends to gravitate toward employers who value sound governance in the form of transparency, ethical behavior, and responsible decision‐making.

One board member I interviewed as part of my research for this book explained that improving governance was her driving motivation to become an independent director. She shared:

When I dealt with boards, I realized that a lot of board members are detached from business and ecosystem. They're career board members. It's almost like becoming inbred. The way to fight it is to make sure that the other large enterprises take the necessary step to save themselves and have impact on the ecosystem so that we don't end up with only three companies in the world.

THE CASE FOR GENDER AND ETHNIC DIVERSITY ON CORPORATE BOARDS

Although poor governance has a long global history, the push for diversity on boards did not begin in earnest until the early 2000s as corporate scandals and questionable business tactics grew rampant. Psychologist and Stanford professor Philip Zimbardo, who created the 1971 watershed Stanford prison experiment and later produced a range of works examining why good people do bad things observed, “Most of the evil of the world comes about not out of evil motives, but somebody saying ‘get with the program, be a team player,’”2 ultimately resulting in uncritical adherence to group norms. Boards tend to be relatively homogeneous compared to the stakeholders they serve, and researchers suggest that this lack of diversity is the reason for poor corporate governance and missed opportunities. Researchers have found that homogeneous boards lack cognitive diversity and are less likely to promote strategies that differ from historical norms and industry competitors.3 In turn, board diversity is believed to be an antidote to the risk of playing well together that instead turns into the slippery slope of groupthink.

Combined with increased risks such as cybercrime and an accelerating pace of change and industry disruption, boards began turning to “refreshment practices,” meaning strategies boards use to periodically evaluate and update their composition, bringing in new members with relevant skills, expertise, and perspectives to ensure they had the human capital they needed to fulfill their mandates and navigate the complex demands they faced. These pressures led businesses, institutional investors, stock exchange indexes, government leaders, and other policymakers to argue for increased gender and ethnic diversity in the boardroom.

The focus on board diversity has been accompanied by a rash of gender diversity research and a somewhat less vigorous exploration of board diversity based on race and ethnicity.4 These studies have revealed that not only does board diversity make ethical sense5 but also several practical benefits follow an increase of women and people of color on corporate boards6:

- Normalizes board diversity and development. Research suggests that having at least one‐third of the board directors be female creates a critical mass that normalizes diversity.7 These studies additionally found that such boards are more likely to commit to creating board development practices that enhance the board's operational and strategic control, enhancing organizational performance and innovation.8

- Improves board participation. Attendance at periodic board meetings is essential because directors carry out their board duties during these meetings. Studies show that women directors have better board meeting attendance, prepare better for meetings, engage more actively, and require more robust discussion compared to their male counterparts.9 These same studies indicate that male directors' attendance, preparation, and participation improve in response to their female colleagues' behavior, thus improving board decision‐making and performance.10

- Improves market understanding and decisions. Women and ethnically diverse directors help the board gain a broader understanding of the marketplace, its stakeholders, and complex issues. These fresh perspectives aid in correcting informational biases during problem‐solving, leading to improved decisions, oversight, and organizational bottom lines.11

- Creates productive conflict. Although more homogeneous boards tend to be more cohesive and have less debate and conflict,12 sthese debates have a high likelihood of being productive, as women directors have been found to have enhanced collaboration skills, heightened sensitivity toward others, and increased ability to resolve task‐related and interpersonal disagreements.13 Without conflict negotiation skills on the board, however, heterogeneous...

| Erscheint lt. Verlag | 29.4.2025 |

|---|---|

| Sprache | englisch |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management |

| Schlagworte | Board diversity • Board of Directors • board readiness • Career Advancement • Corporate Governance • Mentorship • Networking • Organizational Success • Personal Growth • professional development • Resilience • Strategic thinking • Tarang Amin • women leadership |

| ISBN-10 | 1-394-33179-7 / 1394331797 |

| ISBN-13 | 978-1-394-33179-6 / 9781394331796 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich