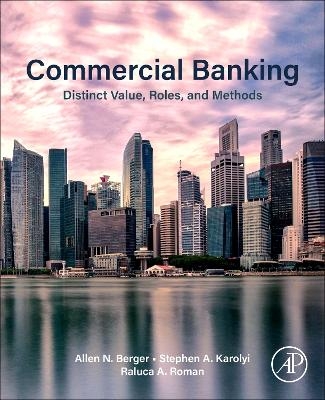

Commercial Banking

Academic Press Inc (Verlag)

978-0-443-36398-6 (ISBN)

This book begins by answering the simple questions: What do banks do? What are the core roles and methods of banks, and what unique value do they provide? From here, the book considers key issues in banking, regulation, coping with bank risk, competition amongst banks, global banking, careers in banking, and future directions. Throughout, emphasis is placed on differentiating between bank and non-bank financial firms, the impact of technology on banking, evolving regulatory environments, the economic importance of banking, and innovation in banking services.

Perfect for undergraduate, graduate level, and professional courses in banking, bank management, and commercial banking, Commercial Banking: Distinct Value, Roles, and Methods is reinforced with full-color figures, charts, tables, learning objectives, and key term definitions.

Allen N. Berger is H. Montague Osteen, Jr., Professor in Banking and Finance at the University of South Carolina, President of the Financial Intermediation Research Society, Senior Fellow at the Wharton Financial Institutions Center, and Fellow of the European Banking Center. He has published over 125 articles in refereed journals, including in top finance journals, Journal of Finance, Journal of Financial Economics, and top economics journals, Journal of Political Economy and American Economic Review. He is co-author of two research books and co-edited all three editions of the Oxford Handbook of Banking. He serves on nine journal editorial boards, co-edited eight special issues of research journals, and formerly edited the Journal of Money, Credit, and Banking. His research has been cited over 90,000 times, including 30 articles with over 1,000 citations each, and another 19 with over 500 citations each. He has given invited keynote addresses on five continents. Stephen A. Karolyi is Associate Professor of Finance at the Costello College of Business of George Mason University. He was formerly a Senior Economic Advisor at the Office of the Comptroller of the Currency, US Department of the Treasury, taught undergraduate and graduate courses in finance, accounting, and applied econometric methods at Carnegie Mellon University’s Tepper School of Business, and earned his PhD in Financial Economics from Yale University. He is a Vice-President and member of the Executive Committee of the International Banking, Economics, and Finance Association. His research is focused on banking and financial intermediation, financial institutions, and corporate finance, and he has published articles in top finance and accounting journals, including the Journal of Finance, Review of Financial Studies, Management Science, Journal of Financial and Quantitative Analysis, Review of Finance, Review of Corporate Finance Studies, Journal of Accounting and Economics, Journal of Accounting Research, and Review of Accounting Studies. Raluca A. Roman is Senior Economist at the Federal Reserve Bank of Philadelphia, and formerly at the Federal Reserve Bank of Kansas City. She holds a Ph.D. in Finance from University of South Carolina. Her research areas include banking and financial institutions consumer finance, corporate finance, and international finance. She has published articles in the Journal of Financial and Quantitative Analysis, Management Science, Journal of Financial Intermediation, Journal of Money, Credit, and Banking, Financial Management, Journal of Corporate Finance, Journal of International Money and Finance, Journal of Banking and Finance, and has received four awards for her papers at conferences. She also co-authored the book TARP and other Bank Bailouts and Bail-Ins around the World: Connecting Wall Street, Main Street, and the Financial System (2020, Elsevier). Raluca has presented her research and discussed the research of others at numerous finance and regulatory conferences.

Part I. The value, roles, and methods of banking

1. What Do Banks Do?

2. The Main Roles of Banking

3. The Main Methods of Banking

4. The Originate-to-Distribute (OTD) Model

Part II. Key issues in banking

5. Systemic Risks, Cycles, and Crises

6. Systemically Important Banks

7. Central Banking

8. Banking in the U.S.

9. International Banking

Part Ill. Coping with bank risk for bank managers and prudential authorities

10. How Risks Are Managed

11. Interest Rate Risks and Other Market Risks

12. Credit Risk

13. Operational Risk

14. Liquidity Risk

15. Leverage Risk

16. Suggestions for Improving Risk Management

Part IV. Banking competition

17. Static Competition with Other Banks

18. Static Competition with Other Financial Institutions and Markets

19. Dynamic Competition for Innovation in Banking

Part V. Banking topics of the future

20. Distinct Value in the Digital Future - Banks Versus Digital Financial Firms (DFFs)

21. The "Expect the Unexpected" Framework for Banking Policy

| Erscheinungsdatum | 02.09.2025 |

|---|---|

| Verlagsort | San Diego |

| Sprache | englisch |

| Maße | 191 x 235 mm |

| Gewicht | 450 g |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| ISBN-10 | 0-443-36398-6 / 0443363986 |

| ISBN-13 | 978-0-443-36398-6 / 9780443363986 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich