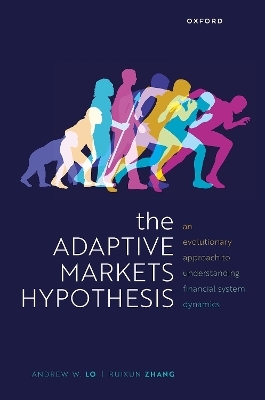

The Adaptive Markets Hypothesis

Oxford University Press (Verlag)

978-0-19-968114-3 (ISBN)

The Adaptive Markets Hypothesis (AMH) presents a formal and systematic exposition of a new narrative about financial markets that reconciles rational investor behaviour with periods of temporary financial insanity. In this narrative, intelligent but fallible investors learn from and adapt to randomly shifting environments. Financial markets may not always be efficient, but they are highly competitive, innovative, and adaptive, varying in their degree of efficiency as investor populations and the financial landscape change over time.

Andrew Lo and Ruixun Zhang develop the mathematical foundations of the AMH--a simple yet surprisingly powerful set of evolutionary models of behaviour--and then apply these foundations to show how the most fundamental economic behaviours that we take for granted can arise solely through natural selection. Drawing on recent advances in cognitive neuroscience and artificial intelligence, the book also explores how our brain affects economic and financial decision making.

The AMH can be applied in many contexts, ranging from designing trading strategies, to managing risk and understanding financial crises, to formulating macroprudential policies to promote financial stability. This volume is a must read for anyone who has ever been puzzled and concerned by the behaviour of financial markets and the implications for their personal wealth, and seeks to learn how best to respond to such behaviour.

Andrew W. Lo is the Charles E. and Susan T. Harris Professor at the MIT Sloan School of Management, director of the MIT Laboratory for Financial Engineering, a principal investigator at the MIT Computer Science and Artificial Intelligence Laboratory, and an affiliated faculty member of the MIT Department of Electrical Engineering and Computer Science. He is also an external faculty member of the Santa Fe Institute and a research associate of the National Bureau of Economic Research. Lo received a B.A. in economics from Yale University in 1980 and an A.M. and Ph.D. in economics from Harvard University in 1984. Ruixun Zhang is an assistant professor and Boya Young Fellow in the School of Mathematical Sciences at Peking University (PKU). He is also affiliated with the PKU Laboratory for Mathematical Economics and Quantitative Finance, the PKU Center for Statistical Science, and the PKU National Engineering Laboratory for Big Data Analysis and Applications. Prior to joining PKU, he worked at several places including Google and Goldman Sachs. Zhang received Ph.D. in applied mathematics from MIT in 2015, and B.S. in mathematics and applied mathematics and B.A. in economics from Peking University in 2011. His research interests include evolutionary models of financial behavior, sustainable investing, FinTech, and applications of machine learning.

1: Introduction and Roadmap

2: The Origin of Behaviour

3: Mutation

4: Group Selection

5: Probability Matching

6: Risk Aversion

7: Cooperation

8: Bounded Rationality and Intelligence

9: Learning to be Bayesian

10: The Madness of Mobs

11: Fear, Greed, and Financial Crises

12: The Psychophysiology of Trading

13: What Makes a Good Day Trader?

14: A Computational View of Market Efficiency

15: Maximizing Relative vs. Absolute Wealth

16: Hedge Funds: The Galápagos Islands of Finance

17: What Happened to the Quants in August 2007?

18: Co-Evolution of Financial Markets and Technology

19: The Role of Culture in Finance

20: Regulation and Adaptive Markets

| Erscheinungsdatum | 23.02.2024 |

|---|---|

| Reihe/Serie | Clarendon Lectures in Finance |

| Verlagsort | Oxford |

| Sprache | englisch |

| Maße | 166 x 241 mm |

| Gewicht | 1342 g |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Volkswirtschaftslehre ► Finanzwissenschaft | |

| ISBN-10 | 0-19-968114-7 / 0199681147 |

| ISBN-13 | 978-0-19-968114-3 / 9780199681143 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich