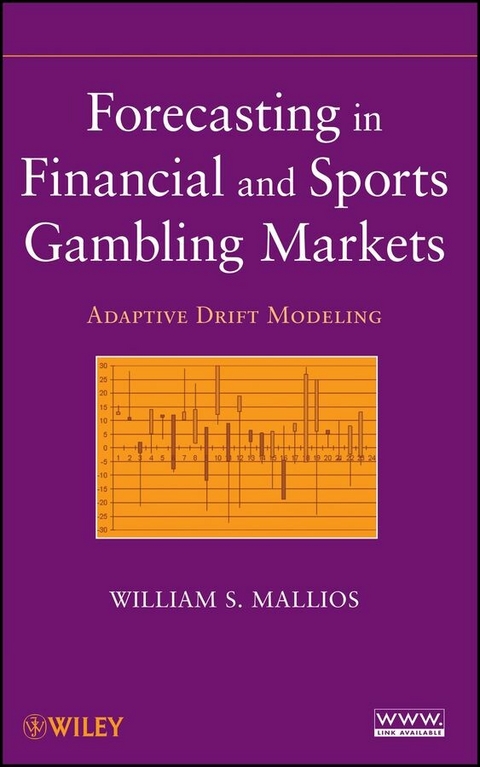

Forecasting in Financial and Sports Gambling Markets (eBook)

John Wiley & Sons (Verlag)

978-0-470-88059-3 (ISBN)

Addressing the highly competitive and risky environments of current-day financial and sports gambling markets, Forecasting in Financial and Sports Gambling Markets details the dynamic process of constructing effective forecasting rules based on both graphical patterns and adaptive drift modeling (ADM) of cointegrated time series. The book uniquely identifies periods of inefficiency that these markets oscillate through and develops profitable forecasting models that capitalize on irrational behavior exhibited during these periods.

Providing valuable insights based on the author's firsthand experience, this book utilizes simple, yet unique, candlestick charts to identify optimal time periods in financial markets and optimal games in sports gambling markets for which forecasting models are likely to provide profitable trading and wagering outcomes. Featuring detailed examples that utilize actual data, the book addresses various topics that promote financial and mathematical literacy, including:

Higher order ARMA processes in financial markets

The effects of gambling shocks in sports gambling markets

Cointegrated time series with model drift

Modeling volatility

Throughout the book, interesting real-world applications are presented, and numerous graphical procedures illustrate favorable trading and betting opportunities, which are accompanied by mathematical developments in adaptive model forecasting and risk assessment. A related web site features updated reviews in sports and financial forecasting and various links on the topic.

Forecasting in Financial and Sports Gambling Markets is an excellent book for courses on financial economics and time series analysis at the upper-undergraduate and graduate levels. The book is also a valuable reference for researchers and practitioners working in the areas of retail markets, quant funds, hedge funds, and time series. Also, anyone with a general interest in learning about how to profit from the financial and sports gambling markets will find this book to be a valuable resource.

A guide to modeling analyses for financial and sports gambling markets, with a focus on major current events Addressing the highly competitive and risky environments of current-day financial and sports gambling markets, Forecasting in Financial and Sports Gambling Markets details the dynamic process of constructing effective forecasting rules based on both graphical patterns and adaptive drift modeling (ADM) of cointegrated time series. The book uniquely identifies periods of inefficiency that these markets oscillate through and develops profitable forecasting models that capitalize on irrational behavior exhibited during these periods. Providing valuable insights based on the author's firsthand experience, this book utilizes simple, yet unique, candlestick charts to identify optimal time periods in financial markets and optimal games in sports gambling markets for which forecasting models are likely to provide profitable trading and wagering outcomes. Featuring detailed examples that utilize actual data, the book addresses various topics that promote financial and mathematical literacy, including: Higher order ARMA processes in financial markets The effects of gambling shocks in sports gambling markets Cointegrated time series with model drift Modeling volatility Throughout the book, interesting real-world applications are presented, and numerous graphical procedures illustrate favorable trading and betting opportunities, which are accompanied by mathematical developments in adaptive model forecasting and risk assessment. A related web site features updated reviews in sports and financial forecasting and various links on the topic. Forecasting in Financial and Sports Gambling Markets is an excellent book for courses on financial economics and time series analysis at the upper-undergraduate and graduate levels. The book is also a valuable reference for researchers and practitioners working in the areas of retail markets, quant funds, hedge funds, and time series. Also, anyone with a general interest in learning about how to profit from the financial and sports gambling markets will find this book to be a valuable resource.

William S. Mallios, PhD, is a consultant at Mallios and Associates, where he provides professional advisement to various financial, medical, and educational institutions. A Fulbright Senior Specialist, Dr. Mallios served as professor of decision sciences at California State University, Fresno, for more than twenty-five years and has provided consulting services for government organizations, including the Food and Drug Administration and Centers for Disease Control.

"This book is a valuable reference for researchers and practitioners in the area of finance. It is also useful for graduate students in financial economics and time series analysis as well as for anyone who wants to profit from financial and sports gambling markets." (Zentralblatt MATH, 2011)

| Erscheint lt. Verlag | 2.2.2011 |

|---|---|

| Zusatzinfo | Charts: 11 B&W, 0 Color; Screen captures: 54 B&W, 0 Color; Graphs: 18 B&W, 0 Color |

| Sprache | englisch |

| Themenwelt | Mathematik / Informatik ► Mathematik ► Statistik |

| Mathematik / Informatik ► Mathematik ► Wahrscheinlichkeit / Kombinatorik | |

| Recht / Steuern ► Wirtschaftsrecht | |

| Technik | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Schlagworte | exploratory drift modeling, cointegrated time series, higher order ARMA processes in financial markets, gambling shocks in sports gambling markets, cointegrated time series with model drift, candlestick charts, algorithmic trading, candle stick charts, financial modeling and sports, financial economics, time series analysis, sports forecasting models • Finance & Investments • Financial Engineering • Finanztechnik • Finanz- u. Anlagewesen • Finanz- u. Wirtschaftsstatistik • Statistics • Statistics for Finance, Business & Economics • Statistik • Time Series • Trend • Vorhersagbarkeit • Zeitreihen |

| ISBN-10 | 0-470-88059-7 / 0470880597 |

| ISBN-13 | 978-0-470-88059-3 / 9780470880593 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich