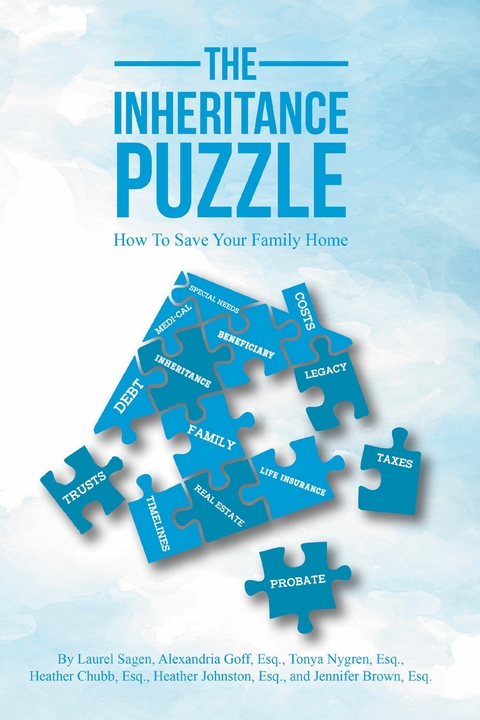

The Inheritance Puzzle (eBook)

132 Seiten

Bookbaby (Verlag)

979-8-3178-2273-6 (ISBN)

Tonya Nygren, Esq., focuses on estate planning, trust administration, and probate law. With a diverse background in real estate development and business ownership, she brings extensive experience in project management and operations. Tonya's transition to law stemmed from a desire to make a positive impact, fueled by personal experiences navigating familial estate issues. Notably, she has successfully litigated against major financial institutions in cases of wrongful foreclosure and negligence. Tonya is committed to educating the public on estate planning's importance and has served as a law professor at Northwestern University. Her client-centric approach and multifaceted expertise make her a trusted advocate for real estate, foreclosure, and estate planning matters. Outside of work, Tonya enjoys travel, hiking, and quality time with loved ones.

Chapter 1: How Probate Works: California Timelines

In this chapter, we will be taking a deep dive into California probate: Sacramento style. Have you ever wondered what probate is and why folks avoid it like a traffic jam on the I-5 during rush hour? Attorney Alexandria Goff’s got your back. Ali is one of the most experienced estate attorneys I know. Her firm manages both modest and complicated trusts as well as the administration of them. If you need advice on trust administration, she wrote the book! If you need to build an estate plan and simply want the best advice possible, you can find that with her. Because Ali has one of the best legal minds I know, I go to her often when we need advice. Get ready to uncover the secrets of probate, understand why it’s public, time-consuming, and costly, and find out how to tackle those fees. Buckle up, and let’s get started!

Probate. The word alone is enough to send shivers down the spines of anyone who’s ever delved into the intricate world of estate management. Like a guest who just won’t leave the party, probate in California is known for its complexities, a patience-testing timeline, and the undeniable costs that accompany it. It’s no wonder many people are on a quest to avoid it. In this chapter, we will take the plunge into California’s probate process, uncovering its quirks, challenges, costs, and most importantly, how to slip through its grasp.

Section 1: What is Probate and Why Avoid It?

What Is Probate?

Probate is the legal spectacle that unfolds after someone’s demise. It is designed to ensure that assets are distributed, debts are settled, and the final curtain comes down on an individual’s financial affairs. Restated, it is the legal process of administering a deceased person’s estate. But what you may not realize is that it is not designed to protect your family; it is intended to protect creditors and debtors! It ends up being a huge hassle for the family you leave behind and here are a few reasons why.

Reasons to Avoid Probate

Picture probate as the circus that decides to pitch its tent right in your backyard and you’ll start to grasp why people would rather avoid it. First and foremost, it is a public process. Probate makes all the financial matters of the deceased public, revealing a list of assets and debts. Your death is posted in the local newspaper, and a list of your financial assets is filed with the court. And anyone can get a copy of those records. Similar to a reality TV show, probate can turn into a drama, airing family disputes and revealing financial secrets you thought were buried.

The second reason is the time commitment. Probate is not a swift journey; it’s a long-haul flight with delays. It can take at least a year to complete, and in some counties, it’s as unpredictable as airport security lines. Some courts take months to get a first hearing on the calendar, all while the deceased family is paying the expenses, mortgage, and other costs until they can get control of the deceased person’s assets. While families might start the process thinking they can get through it on their own, they later realize they need help and have wasted valuable time stuck in probate limbo.

When you add the financial punch: probate is costly. Statutory fees and assorted expenses can chip away at the estate’s value, leaving your heirs with less to inherit. It’s comparable to throwing a party and footing the bill for all the guests. You can expect to pay at least $2,000 in costs in addition to the attorney and executor fees.

Chart of Probate Fees

For those who prefer to analyze numbers rather than dance around them, I have included some real numbers for you to calculate your own probate cost.

As of 2023, the statutory attorney and executor probate fees in California are as follows:

• 4% on the first $100,000

• 3% on the next $100,000

• 2% on the next $800,000

• 1% on the next $9 million

• 0.5% on the next $15 million

For all amounts above $25 million, the court will determine a reasonable compensation amount.

The probate fees are based on the estate’s value (excluding your debt), so the fees are based on the total value, not your equity. Let’s say you have a house in California, a bank account, and personal effects with a total value of $650,000. The fees and costs would be as follows:

• $19,500 attorney fees

• $19,500 executor fees

• $2,000+ costs (filing fees, publication fee, probate referee fee)

• $41,000 total

If you want to estimate what the probate fees will be on your estate, check out this chart.

CALIFORNIA STATUTORY FEES AND COMMISSIONS

(Probate Code Section 10800)

COMPUTATION:

The Emotional Cost

While we’ve focused on the financial toll of probate, let’s not overlook the emotional roller coaster that can come with the ride. Family disputes, unexpected delays, and the public airing of grievances can make probate feel like a never-ending soap opera. Avoiding probate isn’t just about saving money; it’s about preserving family harmony and protecting your loved ones from unnecessary stress.

Section 2: Overview of the California Probate Process and Timeline

Next up, let’s go over what you can expect from the timeline and work involved in the probate process. If you are an executor or administrator, you have a lot of work to do to get through this process. Here is a list of some of the timelines and tasks. Since we only have a few pages, there is no way to go over everything as the process is complicated.

Step 1: Gather Information and Complete Forms

Welcome to the investigative part of probate. Executors become detectives, collecting data on the deceased’s assets and debts, and completing stacks of necessary forms that seem to multiply like rabbits. If the decedent had a will, it needs to be lodged with the court. If they didn’t, we would follow California law to determine who is in charge and who the beneficiaries are. Once these forms are ready, they’re sent off to court to kick-start the probate proceedings with a bureaucratic flourish.

Step 2: Notice to Creditors and Heirs

After the paperwork shuffle, it’s time to wear the hat of a postmaster. Executors have the privilege of notifying creditors and heirs about the probate proceedings, an invitation nobody really wants to receive. It’s like announcing a family meeting where the skeletons in the financial closet are about to be exposed. All the heirs get notice, so if you didn’t want a certain family member to know about your assets, well, you are out of luck as they get copies of notices and might even inherit your money in the end.

Step 3: Appointment at First Hearing

In this corner, we have the first hearing, where the court appoints an executor or administrator to take charge of the estate. This is the individual who gets to navigate the maze of probate’s twists and turns. It’s akin to becoming the reluctant ringmaster of the probate circus. Honestly, acting as the executor is no fun. Sometimes you get challenged by family members who want the job. Other times, you are the only one who will do it and now have a second job! And don’t forget about that pesky paperwork. I have seen so many people try to fill out the forms only to get to court months later and find out they missed something and must come back in another three months!

Step 4: Appraise Assets, Pay Creditors, and Address Taxes

Now, the real detective work begins. Executors must appraise every asset within the estate and make sure no item is left off the list. They also get to play the role of debt collector, paying off any outstanding debts and facing the thrilling task of addressing tax matters so that no financial stone is left unturned. (See Chapter 6, Addressing Debts and Other Responsibilities.) Visualize trying to put together a jigsaw puzzle with missing pieces while managing a financial obstacle course. And remember those fees from earlier. The probate referee gets a fee for appraising everything.

If everything is in order, then the executor can sell assets during this phase. Real estate and other assets can be liquidated. And yes, there’s even more paperwork as the executor must notify beneficiaries about the sale of certain assets before they can be sold.

Don’t forget that during this time, all the expenses, mortgages, property taxes, and other expenses must be paid. And the beneficiaries receive nothing as they have to wait until the final accounting, which can take over a year or more!

Step 5: Petition to Account and Distribution

After everything is liquidated or ready to be distributed, then you guessed it . . . it’s time for another round of paperwork. This time, it’s the petition for distribution to beneficiaries. This phase marks the transition from debt and tax management to the main event: asset distribution. It’s the final preparation for what has seemed to be an endless process. A final accounting is also provided to the court to let the beneficiaries know what the executor has done and what is left to be given to the heirs/beneficiaries.

Step 6: Final Hearing and Distribution

The final hearing is the grand finale of this bureaucratic...

| Erscheint lt. Verlag | 28.10.2025 |

|---|---|

| Sprache | englisch |

| Themenwelt | Sachbuch/Ratgeber ► Gesundheit / Leben / Psychologie ► Lebenshilfe / Lebensführung |

| ISBN-13 | 979-8-3178-2273-6 / 9798317822736 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Größe: 4,3 MB

Digital Rights Management: ohne DRM

Dieses eBook enthält kein DRM oder Kopierschutz. Eine Weitergabe an Dritte ist jedoch rechtlich nicht zulässig, weil Sie beim Kauf nur die Rechte an der persönlichen Nutzung erwerben.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich