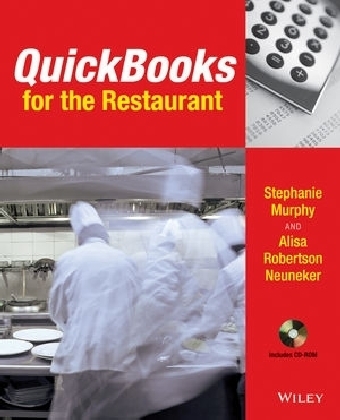

QuickBooks for the Restaurant

John Wiley & Sons Inc

978-0-470-08518-9 (ISBN)

- Titel ist leider vergriffen;

keine Neuauflage - Artikel merken

A step-by-step guide to tracking revenue and expenses, QuickBooks for the Restaurant provides detailed instructions on how to apply the various functions of QuickBooks to control expenses, increase profits, and make informed management decisions. This comprehensive guide contains practical and realistic industry scenarios and practice problems with a section on the simulated financial activity of a typical restaurant operation. Full of helpful accounting advice, QuickBooks tips, and industry scenarios, this book demonstrates how to employ one of the most widely used accounting applications to ensure the financial success of all types of foodservice operations.

Stephanie Murphy, CPA, and ALISA R. NEUNEKER are both Assistant Professors of Business Management at The Culinary Institute of America in Hyde Park, New York.

Preface ix

Chapter 1: Introduction 1

About This Book 1

Overview of QuickBooks Software 4

Importance of the Accounting Process to the Restaurant Manager 6

Obtaining QuickBooks Help 7

Aroma Ristorante’s Operating Processes and Activities 9

Chapter 2: Setting Up Your Restaurant in QuickBooks 11

EasyStep Interview—Creating a New Company File 11

Backing Up and Restoring QuickBooks Files 19

Establishing Company Preferences 21

Setting Up an Additional Bank Account 27

Recording Opening Balances 28

Setting Up QuickBooks to Manually Accept Payroll 28

Chapter 3: Working with Lists 45

Using Lists 45

Using the Chart of Accounts 46

Creating and Editing Accounts 46

Deleting Accounts 51

Making an Account Inactive 51

Creating a Vendor from the Vendor Center 52

Creating a Customer from the Customer Center 54

Creating an Item 57

Editing and Deleting a Vendor, Customer, and Item 59

Identifying the Role of Classes 59

Preparing Lists 59

Chapter Review Problems 65

Chapter 4: Restaurant Purchases, Payables, and Inventory 69

The Purchasing Process 70

Working with Purchase Orders 70

Receiving Goods 73

Entering Bills 76

Editing Bills 78

Voiding and Deleting Bills 79

Memorizing Bills 80

Paying Bills 83

Using Vendor Discounts 85

Using Vendor Credits 86

Using the Check Register 89

Creating and Printing Checks 90

Editing, Voiding, and Deleting Checks 92

Inventory Stock Status (Inventory on Hand) and Par Levels 93

Physical Inventory Worksheets 94

Making Inventory Adjustments 96

Other Inventory Management Systems 98

Reports 99

Chapter Review Problems 105

Chapter 5: Sales and Receivables 109

Recording Sales and Receivables 109

Point-of-Sale Systems Interfaces 110

Recording Restaurant Sales from a Point-of-Sale System 112

Creating Customer Invoices 115

Editing Customer Invoices 117

Voiding and Deleting Customer Invoices 118

Printing Customer Invoices 119

Recording Customer Payments 120

Recording Credit Memos 122

Creating Customer Estimates 124

Recording Advance Deposits 126

Reports 129

Chapter Review Problems 134

Chapter 6: Payroll 139

Payroll and the Restaurant Industry 139

QuickBooks Payroll Options 140

Creating a New Employee Record 142

Editing an Employee Record 146

Creating Employee Paychecks 146

Editing, Voiding, and Deleting Paychecks 151

Releasing Employees and Inactivating Employee Records 152

Outsourcing Payroll 154

Reports 155

Chapter Review Problems 160

Chapter 7: Adjusting Journal Entries 165

Identifying the Steps of the Accounting Cycle 165

Preparing a Journal 166

Preparing a General Ledger 167

Preparing a Trial Balance 168

Recording Adjusting Journal Entries 169

Chapter Review Problems 176

Chapter 8: Financial Reporting and Analysis 179

Financial Statements 179

Preparing the Profit & Loss Statement 180

Preparing the Balance Sheet 186

Preparing the Statement of Cash Flows 187

Preparing the Cash Flow Forecast 189

Chapter Review Problems 191

Chapter 9: Budgeting 193

Preparing an Operating Budget 193

Reports 195

Chapter Review Problems 200

Chapter 10: Year-End Procedures and Reporting 203

Payroll Tax Forms 203

Form 941: Employer’s Quarterly Federal Tax Return 204

Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return 204

Form W-2: Wage and Tax Statement and Form W-3 Transmittal of Wage and Tax Statements 209

Form 1099 MISC: Miscellaneous Income and Form 1096: Annual Summary and Transmittal of US Information Return 210

The Closing Process 212

Chapter Review Problems 213

Chapter 11: Other Restaurant Functions 215

Managing Fixed Assets 215

Recording the Stock Issuance 217

Recording the Dividend Distribution 219

Establishing a Petty Cash Fund 220

Writing Off Accounts Receivable 221

Recording Gift Certificate (Gift Card) Transactions 222

Recording Sales Tax Payments 224

Preparing the Bank Reconciliation 225

Chapter Review Problems 226

Chapter 12: Comprehensive Project 227

Comprehensive Project Objectives 227

Option A 228

Option B 228

Reports 271

Chapter Review Problems 272

Glossary 275

Index 281

| Erscheint lt. Verlag | 10.3.2009 |

|---|---|

| Zusatzinfo | Photos: 3 B&W, 0 Color; Screen captures: 150 B&W, 0 Color |

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 183 x 234 mm |

| Gewicht | 590 g |

| Einbandart | Paperback |

| Themenwelt | Mathematik / Informatik ► Informatik |

| Wirtschaft | |

| ISBN-10 | 0-470-08518-5 / 0470085185 |

| ISBN-13 | 978-0-470-08518-9 / 9780470085189 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich