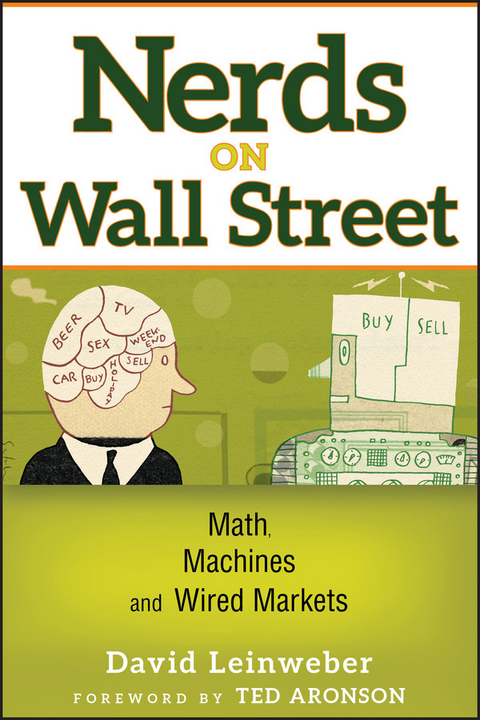

Nerds on Wall Street (eBook)

400 Seiten

John Wiley & Sons (Verlag)

978-0-470-50053-8 (ISBN)

markets, from an innovator on the frontlines of this

revolution

Nerds on Wall Street tells the tale of the ongoing

technological transformation of the world's financial markets. The

impact of technology on investing is profound, and author David

Leinweber provides readers with an overview of where we were just a

few short years ago, and where we are going. Being a successful

investor today and tomorrow--individual or institutional--involves

more than stock picking, asset allocation, or market timing: it

involves technology. And Leinweber helps readers go beyond the

numbers to see exactly how this technology has become more

responsible for managing modern markets. In essence, the financial

game has changed and will continue to change due entirely to

technology. The new "players," human or otherwise, offer investors

opportunities and dangers. With this intriguing and entertaining

book, Leinweber shows where technology on Wall Street has been,

what it has meant, and how it will impact the markets of tomorrow.

DAVID LEINWEBER is a Haas Fellow in Finance at the Haas School of Business at UC Berkeley, and founding Director of the Center for Innovative Financial Technology at Berkeley. He is the founder of two pioneering financial technology firms and successfully managed multibillion-dollar institutional portfolios for many years. Dr. Leinweber has consulted, published, and lectured widely on the use of advanced technology, artificial intelligence, and intelligence amplification in finance--always in an easy and accessible way--and has earned the reputation as "class clown of the quantitative investing industry." He received BS degrees in physics and electrical engineering from the Massachusetts Institute of Technology and a PhD in applied mathematics from Harvard University.

Foreword by Ted Aronson.

Acknowledgments.

Introduction.

Part One 1: Wired Markets.

Chapter 1: An Illustrated History of Wired Markets.

Chapter 2: Greatest Hits of Computation in Finance.

Chapter 3: Algorithm Wars.

Part Two: Alpha as Life.

Chapter 4: Where Does Alpha Come From?

Chapter 5: A Gentle Introduction to Computerized Investing.

Chapter 6: Stupid Data Miner Tricks.

Part Three: Artificial Intelligence and IntelligenceAmplification.

Chapter 7: A Little AI Goes a Long Way on Wall Street.

Chapter 8: Perils and Promise of Evolutionary Computation onWall Street.

Chapter 9: The Text Frontier: AI, IA, and the New Research.

Chapter 10: Collective Intelligence, Social Media, and WebMarket Monitors.

Chapter 11: Three Hundred Years of Stock Market Manipulations:From the Coffeehouse to the World Wide Web.

Part Four: Nerds Gone Wild: Wired Markets inDistress.

Chapter 12: Shooting the Moon: Stupid Financial TechnologyTricks.

Chapter 13: Structural Ideas for the Economic Rescue: FractionalHomes and New Banks.

Chapter 14: Nerds Gone Green: Nerds on Wall Street, off WallStreet.

Index.

About the Web Site.

"Where technology will take investing and trading in the future is anyone's guess. Yet, David J. Leinweber in his newly published book, "Nerds on Wall Street: Math, Machines and Wired Markets," provides a glimpse of the direction. In his lively -- alternately raucous and reverent, deriding and respectful -- Mr. Leinweber recounts the history of how technology has transformed investing and trading through the people that developed ideas and pioneered applications, most famously in indexing, optimization and quantitative investing. . . The book makes one of the best reads of the summer -- suitable for the beach as well as for a serious reader in suit and tie at the office." (Pensions & Investments)

| Erscheint lt. Verlag | 14.5.2009 |

|---|---|

| Vorwort | Theodore R. Aronson |

| Sprache | englisch |

| Themenwelt | Mathematik / Informatik ► Informatik ► Web / Internet |

| Recht / Steuern ► Wirtschaftsrecht | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Schlagworte | Finance & Investments • Finanz- u. Anlagewesen • Finanzwesen |

| ISBN-10 | 0-470-50053-0 / 0470500530 |

| ISBN-13 | 978-0-470-50053-8 / 9780470500538 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich