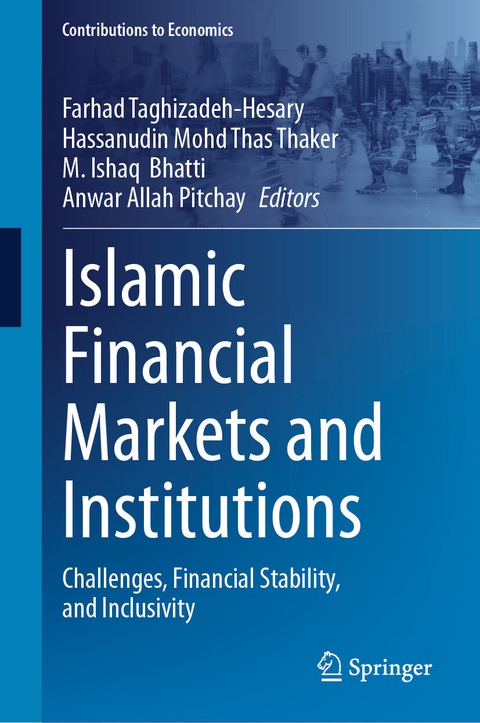

Islamic Financial Markets and Institutions (eBook)

334 Seiten

Springer (Verlag)

978-981-96-8650-6 (ISBN)

Islamic finance has experienced significant growth, particularly in the Middle East, driven by financial innovation and the expansion of asset securitization. This progress is crucial for the future development of Islamic financial institutions (IFIs), but it also requires a strong regulatory framework and effective monetary policies to ensure stability and inclusivity. Maintaining compliance with Islamic law while addressing modern financial challenges presents unique complexities, from risk-sharing mechanisms to the integration of digital banking.

This book examines the evolving landscape of Islamic finance, exploring the challenges that IFIs face, including limited financial inclusion, the dominance of non-Muslim ownership, and gaps in regulatory oversight. It emphasizes the importance of transparency, standardized regulations, and incorporating Shariah compliance into financial supervision. Through empirical research and case studies from various markets, including Iran, Malaysia, and Indonesia, the book highlights the risks and opportunities within Islamic financial markets.

Key topics include financial inclusion, regulatory reforms, the resilience of Islamic finance during economic crises, and the role of fintech in expanding access to Islamic financial services. The book also discusses innovative financial instruments, such as Islamic crowdfunding, green sukuk, and Takaful, highlighting their potential to promote sustainable development. It argues that while Islamic finance offers ethical and stable alternatives to conventional banking, stronger governance, technological integration, and policy reforms are necessary to ensure its long-term viability.

Bringing together insights from leading researchers and practitioners, this book provides a comprehensive analysis of the current state and prospects of Islamic finance. It is an essential resource for policymakers, financial regulators, and industry professionals looking to enhance financial stability and inclusivity within the Islamic financial system.

Islamic finance has experienced significant growth, particularly in the Middle East, driven by financial innovation and the expansion of asset securitization. This progress is crucial for the future development of Islamic financial institutions (IFIs), but it also requires a strong regulatory framework and effective monetary policies to ensure stability and inclusivity. Maintaining compliance with Islamic law while addressing modern financial challenges presents unique complexities, from risk-sharing mechanisms to the integration of digital banking.This book examines the evolving landscape of Islamic finance, exploring the challenges that IFIs face, including limited financial inclusion, the dominance of non-Muslim ownership, and gaps in regulatory oversight. It emphasizes the importance of transparency, standardized regulations, and incorporating Shariah compliance into financial supervision. Through empirical research and case studies from various markets, including Iran, Malaysia, and Indonesia, the book highlights the risks and opportunities within Islamic financial markets.Key topics include financial inclusion, regulatory reforms, the resilience of Islamic finance during economic crises, and the role of fintech in expanding access to Islamic financial services. The book also discusses innovative financial instruments, such as Islamic crowdfunding, green sukuk, and Takaful, highlighting their potential to promote sustainable development. It argues that while Islamic finance offers ethical and stable alternatives to conventional banking, stronger governance, technological integration, and policy reforms are necessary to ensure its long-term viability.Bringing together insights from leading researchers and practitioners, this book provides a comprehensive analysis of the current state and prospects of Islamic finance. It is an essential resource for policymakers, financial regulators, and industry professionals looking to enhance financial stability and inclusivity within the Islamic financial system.

| Erscheint lt. Verlag | 27.8.2025 |

|---|---|

| Reihe/Serie | Contributions to Economics |

| Zusatzinfo | XVI, 334 p. 52 illus., 49 illus. in color. |

| Sprache | englisch |

| Themenwelt | Geisteswissenschaften ► Religion / Theologie ► Islam |

| Wirtschaft ► Betriebswirtschaft / Management ► Allgemeines / Lexika | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Wirtschaft ► Betriebswirtschaft / Management ► Unternehmensführung / Management | |

| Wirtschaft ► Volkswirtschaftslehre | |

| Schlagworte | Financial Inclusion • FinTech • Islamic Banking • Islamic Finance • Regulatory Convergence • Wealth distributions |

| ISBN-10 | 981-96-8650-4 / 9819686504 |

| ISBN-13 | 978-981-96-8650-6 / 9789819686506 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür einen PDF-Viewer - z.B. den Adobe Reader oder Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür einen PDF-Viewer - z.B. die kostenlose Adobe Digital Editions-App.

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich